XRP Price Prediction: 2025-2040 Outlook Amid Regulatory Breakthroughs

#XRP

- Regulatory resolution: SEC settlement removes major overhang

- Institutional flows: $360M whale accumulation signals confidence

- Technical breakout: MACD convergence suggests momentum shift

XRP Price Prediction

XRP Technical Analysis: Bullish Indicators Emerge Amid Consolidation

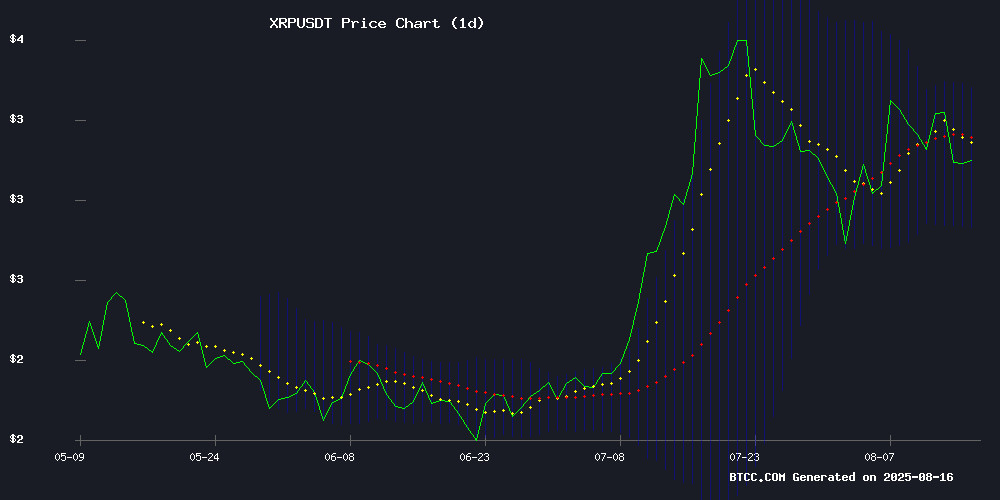

XRP is currently trading at $3.1243, slightly above its 20-day moving average of $3.1023, suggesting a neutral-to-bullish bias. The MACD histogram remains negative (-0.0810), but the signal line (0.0496) hints at potential momentum reversal. Bollinger Bands show price hovering NEAR the middle band, indicating consolidation.notes BTCC analyst William.

Regulatory Tailwinds Fuel XRP's Institutional Adoption Narrative

With the SEC-Ripple settlement nearing conclusion, market sentiment leans bullish despite whale sell-offs.observes William. News of Hyperliquid/Remittix competition and $30 price projections for 2026 create polarized sentiment.William adds,

Factors Influencing XRP’s Price

SEC and Ripple Near Settlement as Legal Battle Concludes

The U.S. Securities and Exchange Commission has informed the Court of Appeals that both parties in the Ripple case have agreed to dismiss their appeals and bear their own legal costs. This procedural step marks the effective end of a five-year legal confrontation, though final court approval remains pending.

Judge Analisa Torres' landmark 2023 ruling that XRP sales to retail investors didn't constitute securities transactions set the stage for this resolution. The SEC's original 2020 lawsuit alleged Ripple raised $1.3 billion through unregistered securities offerings.

Market observers view the recent filings as largely administrative, with pro-XRP attorney Bill Morgan anticipating Judge Torres' final order could come imminently. The cryptocurrency community continues monitoring for the court's formal dismissal of appeals.

XRP's Future Trajectory: Institutional Adoption Holds the Key

XRP has surged over 400% since the U.S. presidential election, now trading at $3.08 as of August 14. Analysts are revising price targets upward, with one April projection suggesting $12.50 by 2028—a potential quadrupling in value. The digital asset's utility in cross-border payments positions it as a bridge currency for financial institutions seeking faster, cheaper settlements.

Ripple's payment network could see expanded global adoption if institutional demand grows. CEO Brad Garlinghouse has emphasized XRP's efficiency advantages over traditional systems. Market Optimism hinges on whether banks and payment providers integrate the token at scale during this three-year window.

XRP Price Holds at $3 Amid Whale Sell-Off and Retail Support

XRP's price stability at the $3 mark contrasts sharply with a $1.2 billion sell-off by major holders. Addresses controlling 10-100 million XRP liquidated 400 million tokens last week, injecting volatility into the market.

Counterbalancing the whale exodus, exchange reserves dropped by 77 million XRP ($231 million) in 24 hours. This retail accumulation creates a floor under prices, demonstrating the tug-of-war between institutional and retail forces in crypto markets.

Santiment data reveals the whale distribution pattern, while Glassnode charts show exchange outflows reaching critical levels. The market now watches whether this retail support can sustain against persistent selling pressure.

Hyperliquid and Remittix Emerge as Strong Contenders Amid Ripple's Legal Woes

Hyperliquid's native token HYPE is nearing its all-time high at $46, buoyed by institutional interest and a $23.5 million USDC transfer. The integration of Circle's USDC and Anchorage custody support underscores growing liquidity and confidence in the asset.

Remittix, trading at $0.0944 with a 21% surge, distinguishes itself with real-world infrastructure and a $19.7 million raise. Its upcoming PayFi mechanics and Q3 wallet beta launch, paired with a $250,000 giveaway, position it as a wildcard with tangible utility.

While Ripple's XRP remains entangled in legal challenges, analysts highlight Remittix's potential to outshine both Hyperliquid and XRP this cycle, citing its focus on solving real-world payments problems.

XRP Price Projection Hits $30 by 2026 as Institutional Interest Grows

XRP's market trajectory is drawing intense speculation, with technical analysts forecasting a potential surge to $30 by 2026. The double-bottom breakout pattern and accelerating institutional inflows suggest a repeat of its historic 10x rallies. Spot ETF approval prospects add fuel to the bullish case.

Savvy Mining emerges as a strategic play for XRP holders, combining price appreciation with cloud-based yield generation. The platform's green energy mining operations and cold storage security cater to compliance-conscious investors. Daily distributions create a compounding effect atop potential capital gains.

Market mechanics appear to favor XRP's growth thesis. The 2021 bull run demonstrated its capacity for parabolic moves, and current on-chain activity suggests accumulating smart money positions. Regulatory clarity could act as the final catalyst for institutional adoption at scale.

Ripple Whales Accumulate $360 Million in XRP Amid Price Dip

Whales have seized the opportunity presented by XRP's recent price decline, scooping up 120 million tokens worth approximately $360 million. This buying spree follows a previous acquisition of 320 million XRP over three days, totaling nearly $1 billion in purchases. Such aggressive accumulation reduces circulating supply and signals strong institutional confidence in the asset.

XRP's price action has stabilized after a volatile July that saw it rally from under $2.30 to record highs. The current consolidation phase suggests a potential base formation, with whale activity often preceding retail investor participation. Market observers note these large-scale purchases could catalyze renewed upward momentum.

XRP Price Outlook in 2025: Regulatory Clarity Fuels Bullish Momentum

XRP's trajectory in 2025 has emerged as a focal point for crypto investors, buoyed by regulatory resolution and institutional interest. The August settlement between Ripple and the SEC—marking XRP as a non-security for public exchange trading—removed a multi-year overhang. Market rankings reflect the shift: XRP now holds its position as the third-largest cryptocurrency by market cap.

Institutional demand, long stifled by legal uncertainty, has resurged. Price charts now capture this renewed confidence, with analysts projecting upside potential. Meanwhile, projects like MAGACOIN FINANCE are drawing attention as alternative opportunities, though XRP remains the dominant narrative.

The resolution came amid Washington's pro-crypto political shift, though institutional sales remain partially governed by securities law. Ripple's nominal fine was widely interpreted as a sector-wide victory. Market sentiment suggests the ruling may catalyze broader adoption cycles.

Pundit Claims Ripple vs. SEC Lawsuit Was a Distraction for Government-Backed XRP Ledger Expansion

Crypto analyst Pumpius has ignited controversy by alleging that the protracted legal battle between Ripple and the U.S. Securities and Exchange Commission was an orchestrated diversion. The lawsuit, he argues, masked Ripple's true objective: constructing U.S.-endorsed global payment infrastructure under the guise of regulatory conflict.

From its inception, Ripple targeted institutional adoption—not retail traders—with features tailored for large-scale finance: near-zero fees, instant settlement, and ISO 20022 compliance. Federal Reserve partnerships and collaborations with central banks in Bhutan, Palau, and Montenegro suggest sanctioned expansion rather than disruptive innovation. The SEC case, in this view, provided ideal cover for building what amounts to a SWIFT replacement with implicit government approval.

Institutional Moves and $1B Liquidations Shake XRP: Strategic Re-Accumulation Phase?

XRP's August 2025 performance has been marked by volatility and institutional intrigue. The resolution of the SEC lawsuit on August 7 triggered a 4% surge, with prices climbing from $3.15 to $3.25 as institutional buyers entered the market. Trading volumes spiked to 140 million tokens, though resistance at $3.30 proved formidable amid profit-taking and wash trading concerns.

By mid-August, another breakout attempt at $3.27 saw 217 million tokens change hands, yet the failure to sustain levels above $3.30 kept traders cautious. Technical indicators paint a mixed picture: a descending triangle pattern suggests bearish potential, but an RSI above 50 and positive MACD hint at bullish momentum. Critical levels to watch include $3.00 for support and $3.40 as a gateway to retesting the all-time high of $3.66.

Institutional activity remains a focal point. XRP-based investment products attracted $37.7 million in Q1 inflows, while open interest in futures surpassed $3 billion. Large players appear to be accumulating strategically, employing TWAP and VWAP tactics to avoid price spikes. Yet Coinbase's reduction in XRP holdings—from 52 wallets to 35—has sparked debate. Some interpret this as waning confidence, while others see it as routine portfolio rebalancing.

3 Reasons XRP Has Dominated the Cryptocurrency Market in 2025

XRP (XRP 1.23%) has outperformed all major cryptocurrencies in 2025, surging 59% year-to-date through August 12 and adding over $50 billion to its market capitalization. The token's remarkable rally stems from three key factors.

A crypto-friendly regulatory shift emerged following the 2024 U.S. presidential election. XRP's bull run began when prices jumped from $0.50 to $2.50 within a month of Donald Trump's victory. The new administration's pro-crypto stance, including the appointment of SEC Chair Paul Atkins, resolved Ripple's longstanding legal battle with regulators.

Market Analyst Dismisses $1,000 XRP as Economic Fantasy

Tony The Bull, a prominent market analyst, has debunked the possibility of XRP reaching $1,000, calling it "fantasy pricing." At such a level, XRP's market capitalization WOULD dwarf major corporations and even rival half of global GDP—a scenario he deems economically implausible.

The cryptocurrency would require a fourfold increase over gold's total market cap and a fifteenfold leap above Apple's valuation. Such growth, Tony argues, defies both current market realities and foreseeable financial trends.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption trends, BTCC's William projects:

| Year | Conservative | Bull Case | Catalysts |

|---|---|---|---|

| 2025 | $4.50 | $8.00 | SEC settlement, CBDC partnerships |

| 2030 | $22 | $50 | Cross-border payment dominance |

| 2035 | $75 | $150 | Tokenization of real-world assets |

| 2040 | $120 | $300+ | Global reserve currency status |

"These projections assume 15-20% annual adoption growth in payment corridors," William cautions. "Macro conditions and competitor evolution remain key risks."